Financing options

There are lots of finance options available, speak to one of our Solar Gurus to find out more.

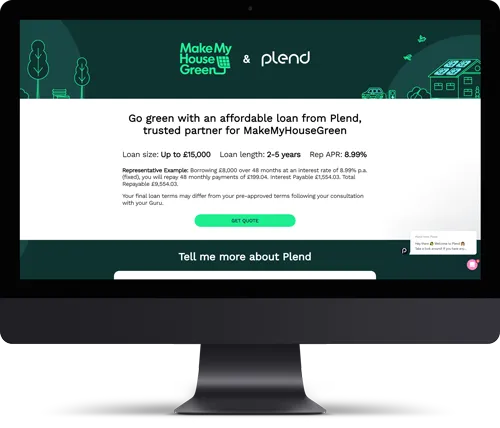

Home improvement loan

Most high street banks offer personal loans for home improvements, including solar installations, and these can be an affordable way to finance a solar system.

We recommend comparing quotes from a range of providers to find the best deal for you. Comparison websites such as MoneySuperMarket or CompareTheMarket can help you to quickly find deals, however be aware that not all providers are available on price comparison websites and the best deals tend to be found by dealing directly with lenders.

We have also included links to some prominent lenders below:

Example home improvement loans

* Rep APR and monthly repayments for a loan value of £10,000 over a 5-year term

Example: Borrowing £10,000 over 60 months at an interest rate of 5.4% p.a. (fixed), you will repay 60 monthly payments of £189.96. Interest Payable £1,397.33. Total Repayable £11,397.33.

Personal vs secured loans

(1) It’s possible that you can lose your home if you don’t pay an unsecured loan, but very unlikely.

The most common loan type used for home renovations is a personal loan (also known as an unsecured loan). This means the loan is not secured against an asset, such as your house. This is easier to set up and does not place you at risk of having your home repossessed if you fail to keep up with repayments, however it will affect your credit score, which may make it difficult to find credit in the future.

Secured loans come at lower interest rates than personal loans and can be taken over longer terms. These require you to secure the loan amount against an asset, typically your house. This takes longer to set up and your home could be repossessed if you fail to keep up with repayments.

For more information on the risks surrounding secured loans, see here

What's in it for you

Mortgage advance

Further advances on a mortgage are a common way of funding home improvements. These allow you to add additional borrowing onto your existing mortgage.

Typically the new borrowing will be at a different rate to the balance of your mortgage, but is likely to be cheaper than a home improvement loan.

A further advance on a mortgage means you keep your current mortgage with the same lender. This can be beneficial if current mortgage deals aren’t as attractive as what is currently available on the market.

Further advance vs remortgage

The main difference between remortgaging to borrow more with your current or a different lender and taking a further advance on your existing mortgage is that a further advance doesn’t force you to switch mortgage deals.

However, if mortgage rates have decreased since you took your mortgage out, it could be more effective to remortgage your whole loan to a lower rate and ask to borrow more as part of this process.